Sri Lanka’s Fixed Income Securities Market

Sri Lanka’s fixed income securities market consists of Treasury Bills, Treasury Bonds, Commercial Paper and Corporate Bonds. Treasury Bills and Bonds (T-bills and T-bonds) are issued by the government via the Central Bank and Commercial Papers are issued by corporate entities through commercial banks. Corporate bonds are longer term debt securities and are offered by corporations.

With the change in the economic environment after the war, Sri Lanka’s fixed income securities market has seen significant changes over the last few years. The two largest impacts over time have been due to a sharp fall in inflation/interest rates and the gradual opening up of the debt market to foreign investors.

Looking back 4 years in 2007/2008 – inflation was very high, while the outlook for the Sri Lankan economy was much less favourable than it is today. In 2007 CCP inflation averaged 15.8% while in 2008 CCPI inflation averaged 22.6%. Given the high inflation environment monetary policy was tight. As a result the 3 Month T Bill rate as at end 2008 was 17.33%. The 4 year T bond as at end 2007 was 20.38%.

With the fall in global commodity prices, the lagged impact of tight monetary policy and the opening up on new agricultural supply from the North East, inflation rates fell. In 2009 the annual average CCPI was 3.4% and in 2010 it was 5.9% and so far for 2011 the annual average CCPI growth rate is.7.2%

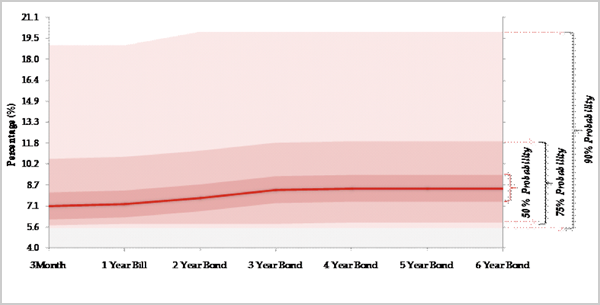

As a result of the fall in inflation the Central Bank relaxed monetary policy. 3 Month T Bills rate as at end 2009 fell sharply to 7.73% . The 4 year T Bond end 2009 fell to 9.78%. The low rates continued in 2010 when the 3 month T bill came down to 7.24% while the 4 year T bond came down to 9.78%. In 2011 at present the 3 Month T bill is at 7.29% and the 4 year T bond is at 9%

The general expectation are that inflation rates will remain subdued and in the single digits in the medium term. As a result the overall expectation is for Sri Lankan interest rates to remain at much lower levels in the future than that seen in the past.

Foreign investors are allowed to buy 10% of the outstanding issue of treasury bills and bond and this limit has been reached. The most recent development announced in the 2011 budget is for permission been given for foreign investors to buy into the corporate debt market, but with some restrictions on the interest rates that can be paid and maturity periods.

Sri Lanka’s sovereign bond launches have met with strong investor approval and been heavily over subscribed. This year Fitch upgraded Sri Lanka’s Ratings to ‘BB-‘ from ‘B+’ . Moody’s upgraded the outlook of Sri Lanka’s B1 foreign currency sovereign rating from ‘Stable’ to ‘Positive’. S&P has a B+ rating on Sri Lanka with a positive outlook. Sri Lanka has sold two 500 million dollar bond and two one billion dollar bond offering since 2007.

However the corporate debt market is in its infancy. Overall volumes in the debt market are a small fraction of that in the government securities market. Compared to the boom seen in the stock market post war, with many new listings and IPOs the developments in corporate debt has so far been subdued. However the general view is that this is the area in the capital markets that would next take off.

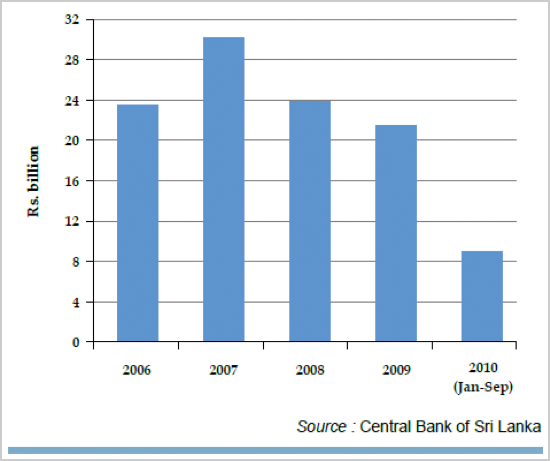

The corporate debt securities market was sluggish during the first nine months of 2010. The total value of commercial paper issued with the support of banks amounted to Rs. 9 billion in the first nine months of 2010 in comparison with Rs. 18 billion in the same period of 2009. The activities in the corporate bond market were also relatively limited due to narrow issuer and investor base. There were two issues of debentures during the first ten months of 2010.

Sri Lankan local institutional investors have a general preference for fixed income investments. They consider fixed income securities to be a safe, stable and a prudent method of protecting your funds during times of volatility.

1 Year Forward (November 2012) Chart of Yield Curve

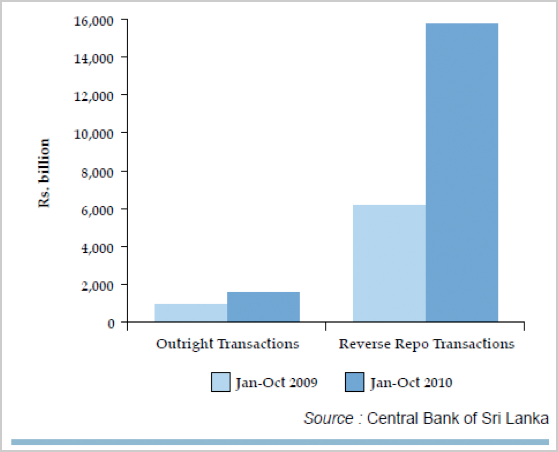

Treasury Bill Transactions in the secondary market 2010

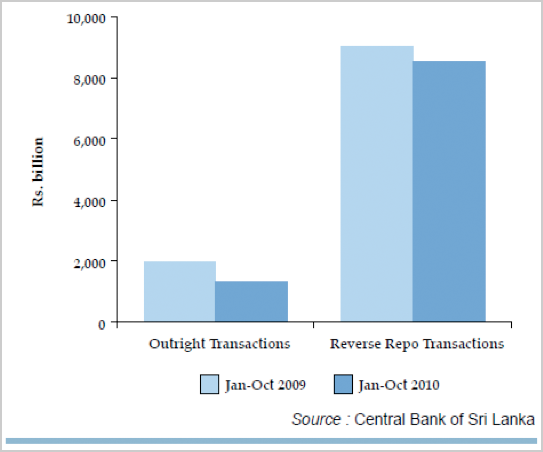

Treasury Bond Transactions in the secondary market, 2010

Commercial paper issues by Central Banks

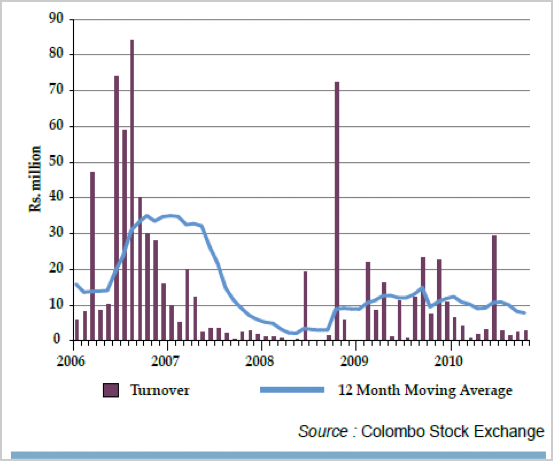

Listed Corporate Bond Market (Monthly turnover)